Contents:

These two swing lows should be connected with a horizontal line to create the key support level. Once price returns to this level, we will want to watch the price action closely for any clues of a potential breakout or reversal. HowToTrade.com takes no responsibility for loss incurred as a result of the content provided inside our Trading Room. By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade.

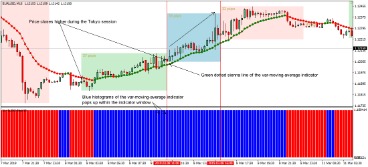

It will require some additional market analysis and as always, excellent money management. Before we discuss how the morning star forex pattern can be traded, we first need to introduce the volume indicator. Traders will often use additional confirmation methods, such as indicators, rather than basing their trading decisions on candlestick patterns alone.

The idea is that the sun is rising, and it should bring in light, or bullish pressure. These of course are based upon descriptions of ancient Japanese candlestick charts. The Morning Star pattern indicates a bullish reversal pattern in technical analysis, indicating a potential reversal of a bearish trend to a bullish trend.

The Morning Star pattern can be observed in the EUR/GBP chart below, where there is an established downtrend leading up to the formation of the reversal pattern. The first is to wait and watch what happens in the session after the pattern. If the bullish move looks like it is continuing, then it might be time to trade. The guy that first taught me how to trade the morning star would have waited for a pullback on this one.

Morning Stars: How To Trade the Morning Star Candlestick Pattern

The small candlestick that gaps below the black candle should close within the body of the black one. Finally, the white candlestick needs to close above the point where the black candle is exactly halfway through its body. Three things to be aware about when trading the Morning StarThe middle session usually takes the shape of a spinning top.

- Spot Gold and Silver contracts are not subject to regulation under the U.S.

- Evening star patterns are classified as bearish reversal indicators.

- The country's hoard of foreign exchange dropped $51.3 billion from the prior month to $3.133 trillion at the end of February, said the State Administration of Foreign Exchange.

- The first candle shows that a downtrend was occurring and the bears were in control.

As such the long entry would be triggered at the start of the following candle as shown on the price chart. Since the Morning Star is a bullish reversal pattern, we will only seek long trade set ups within the strategy. Another technique that some traders utilize for entering into a long position following the Morning Star pattern is to wait for a minor retracement of the third candle. The logic here is that the market should subside a bit following the Morning Star formation, providing a better entry for the long position.

By the end, you’ll be able to apply the evening star to the forex markets in real-time. Morningstar candles have triple candlestick patterns that indicate a bullish reversal. The underlying structure is formed in an upward and downward trend, indicating that the downward trend will reverse. During the formation of the three candlesticks that make up this pattern, traders want to see volume increasing with the most volume present after the close of the third green candlestick. This acts as additional confirmation that price is getting ready for a reversal. However, these patterns are less reliable than other candlestick patterns, such as the engulfing pattern.

Contents

The bigger https://g-markets.net/ appears as a confirmation regardless of what the other indicators attested to the same display. If not, read on to learn more about this powerful formation and how it can be used in forex trading. The pattern shows a slowing of the bearish momentum, market indecision, and a reversal of the trend, as indicated by the long bullish candle.

Correctly spotting reversals is crucial when trading financial markets because it allows traders to enter at attractive levels at the very start of a possible trend reversal. The evening star pattern is a chart formation formed over three sessions that signals an upcoming downtrend. It’s the exact opposite of a morning star – a long green stick, followed by a spinning top, and finally a red stick that acts as the beginning of a bearish reversal. One advantage of using single candlestick patterns is that they may be combined with other formations in real-time. In the case of the evening star, it may be extended into the shooting star candlestick pattern.

A bearish abandoned baby is a type of candlestick pattern identified by traders to signal a reversal in the current uptrend. The evening star is a long white candle followed by a short black or white one and then a long black one that goes down at least half the length of the white candle in the first session. The evening star signals a reversal of an uptrend with the bulls giving way to the bears. If you are new to candlesticks, read our guide to the top 10 candlestick patterns to trade the markets. I learned most of what I know about candlesticks patterns and price action trading from Steve Nison.

The middle candle of the morning star captures a moment of market indecision where the bears begin to give way to bulls. The third candle confirms the reversal and can mark a new uptrend. These are also reversal patterns, appearing at the end of bear runs and signaling a potential end to the downtrend. This is also a reversal pattern, but in this case, it signals the potential end of the uptrend. Patterns made of one or more candlesticks offer a quick way to spot price action that offers a `strong indication of a potential future move.

Evening Star

Like other candlestick patterns, trading forex with evening star patterns is a breeze. All you need to do is recognize the formation (strong bullish candle — Doji — bearish third candlestick), define market entry, set a stop loss, and locate a profit target. A price upswing’s peak, where evening star patterns first appear, is bearish and indicates that the uptrend is about to end. The morning star forex pattern, seen as a bullish reversal candlestick pattern, is the opposite of the evening star pattern. For an example of the evening star candlestick pattern, examine the below chart of Nike stock. In the highlighted area, you can see that the market had been in an uptrend, gapped higher to form a short candlestick, and then gapped lower on the third day to show signs of exhaustion.

Once you identify the Morning Star, it can give you signals to open at the third candle. The presence of a third candle signifies that the price moves upwards, and we could look to go long. It shows bears are still in control, but they are not pushing the price lower. If the second candle is bullish, this is a sign of a more definite reversal. Soon after the close of the second candle, the third candlestick changed direction to the upside, closed with a large green body, and showed a notable increase in volume.

MetaTrader 4 vs. MetaTrader 5 Understand the differences between MT4 and MT5, as well as their features and benefits.What is Social Trading? An evening star is a stock-price chart pattern used by technical analysts to detect when a trend is about to reverse. A doji is a trading session where a security’s open and close prices are virtually equal. Traders will often look for signs of indecision in the market where selling pressure subsides and leaves the market somewhat flat. This is where Doji candles can be observed as the market opens and closes at the same level or very close to the same level. This indecision paves the way for a bullish move as bulls see value at this level and prevent further selling.

Once you’ve identified a morning star pattern, keep an eye out for more indicators that the market is truly reversing. Moving averages, Fibonacci retracement levels, and support and resistance levels are a few instances of confluence elements. A morning star pattern, in Forex, is basically a variation of the bullish engulfing pattern. However, the second candlestick in this three-candle formation must be a low range candle, like a spinning top or doji . The morning star and evening star have a tad bit of difference, and the morning star has a flatter center candlestick, forming the Doji. There are no typical signs displaying anything, and it can show the pattern more clearly than a thick middle candlestick.

It is a suitable format identified by the morning star forex analysts, but trading based on a visual sign might not be the best decision they’d make. Morning stars have the best backup of indicators and function in their best way with their support. If not for them, it would be effortless to identify the formation of a morning star every time a candle starts going towards the downtrend. In this article, we will cover how to identify, interpret, and trade currency pairs with the evening star pattern.

BTC/USD Forex Signal: Bitcoin Outlook is Still Bearish - DailyForex.com

BTC/USD Forex Signal: Bitcoin Outlook is Still Bearish.

Posted: Tue, 28 Feb 2023 06:00:30 GMT [source]

China's foreign-exchange reserves dropped in February, official data showed Tuesday, amid a weaker Chinese yuan against the U.S. dollar. During the pattern, the market cannot decide whether to break up or down. Once either trend line is broken, there may be a substantial move in the direction of the break.

- These candlesticks can signify potential exhaustion at over-extended levels or support and resistance, but by themselves aren’t particularly meaningful.

- All opinions and information contained in this report are subject to change without notice.

- When evaluating online brokers, always consult the broker’s website.

- Typically, you want to see at least three consecutively bearish candles.

Fourth, a significant increase in volume on the third trading day is typically interpreted as a validation of the pattern . There are a few essential factors you need to keep in mind while trading with a Morning Star pattern. First, it is essential to note that the volume has been increasing steadily during the course of the pattern’s three sessions. If these requirements are met, it is likely that the market has found support, and it is probable that it will soon start moving higher.