Contents:

At the bottom of the page, you have the options of Save and New, Save and Close, and Save and Send. Additionally, you can add a memo and attachment to the Receive Payment form. Below the table you can see the total amount that will be applied. If there are credit memos available, then they could also be applied here. By default, QuickBooks Online will enter the total amount.

Matching QuickBooks Online banking transactions can be quite confusing if you have deposited multiple checks at one time. You need to be able to determine which amounts total the deposit and be sure you have correctly recorded the payment from each customer, and the amount deposited to the bank. Haven’t gotten set up to accept credit and debit cards yet? We can get you going with a merchant account to make this possible. You’re likely to find that some customers pay faster with this option.

This time, we'll go to Sales in the Navigation Window and then click on Customers. In the Customers list, find your customer and click the drop-down menu icon in the Action column. There you will see an option for creating a sales receipt.

AskForAccounting Services

Save and New will save the payment and open up a new, empty Receive Payment form. Save and Close will save the payment and return you to your previous screen. Save and Send will save the payment and give you the option to mail it to someone as a PDF. Once you save the file, the payment will be processed and you can then check to confirm. Sometimes, however, a customer will have more than one open invoice and they will send in an amount of money that doesn't cover all the invoices. By default, QuickBooks will apply the payment to the oldest invoice first.

To verify your business, Intuit uses business and owner information. Alternatively, to save the transaction but leave the “Receive Payments” window open, click the “Save & New” button. Repeat step #13 until the entire amount is attributed to the correct invoices in the correct amounts. To remove the checkmarks from the invoices, click the “Un-Apply Payment” button in the “Main” tab of the Ribbon to clear the checkmark from the invoice. Then select the payment date from the “Date” calendar selector.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

Based on your business, there may be more things you want to include. At the very bottom of the screen, there are a few more options for your sales receipt. You can print or preview it, make it recurring, or customize it.

Best Business Websites You Should Be Reading Regularly

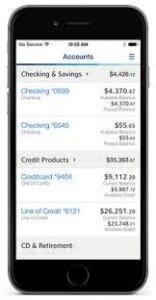

At the top left, start typing your customers name in the customer field and it will auto populate with your customer and all their open invoices. Select the invoice or invoices that you want pay, and then select the payment method and then enter the card information that you want to use for the payment. Once you save and record the payment, QuickBooks Online will post the payment to the customer and the invoice marking it as “Paid” and then confirm this at the top of the screen. To view a detailed receipt of the transaction, just click on the confirmation and it will open up a screen with all the related information. When you receive payment from an invoice, the undefined fund account acts as the default “deposit” account, uses the payment item on the invoice, or enters a sales receipt. This account is created to operate with both receive payments and bank deposit features to perform the invoicing process.

In the image below you can see it https://bookkeeping-reviews.com/ed the invoice for $175. Undeposited Funds allows you to group multiple checks and cash into a single deposit in your check register. Ensure that you apply the payment to the correct customer invoice.

(While you’re there, click the down arrow to familiarize yourself with the other options.) When the Receive Payment window opens, select the Payment method that applies. Leave the Deposit to field showing Undeposited Funds and look over the rest of the screen to make sure everything is accurate. Print it if you’d like and/or add an Attachment using the links at the bottom, then Save it. When you are working with grouped payments, it becomes very easy to manage transactions using the Undeposited Funds account to receive payments.

I'm not going to do that; I'm going to show you another way as well. And then we have another one, one more left from Travis. Maybe we only go to the bank on Friday, or maybe we're going to photograph all of these checks if we're kind of in with this century or decade or whichever. So we've received a lot of money into undeposited funds. Now, obviously we don't want everything sitting in undeposited funds and we need to go to the bank. At the top of the screen, select a Payment Method and select the account in which you want QBO to place the customer's payment.

This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Gentle Frog, LLC does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Gentle Frog, LLC does not warrant that the material contained herein will continue to be accurate, nor that it is completely free of errors when published.

Using the Tipalti Accounts Payable Automation App for QuickBooks to Pay Supplier Invoices

So this means that in our books, it's showing up as paid, no reminders will go out to Duke. It's fully paid, but we have not put it into the bank yet, so we've got it here in undeposited funds. So, we’ll pop here to Freeman's Sporting Goods. Let's have a quick look, which one it is and checking what I prepared earlier.

You can also just leave the Crew Number field blank. You can change the information in the billing address if it is not up-to-date. Doing so will make QuickBooks prompt you to confirm the changes after saving. Once the form is complete, you can save it and move on.

Your customers will be able to click a link in an emailed invoice and make their payments. If you’re like many businesses, you send invoices to customers to let them know what they owe and when their payment is due. So one of the most commonly used ways to record payments is by using the Receive Payments window. To open it, click the Receive Payments icon on the home page or click Customers | Receive Payments.

This process will complete the transaction, thereby recording it in your books. Follow below mention steps to Receive Payments in QuickBooks Online. Once you set this up in QuickBooks Online, your invoices will allow bank cards and electronic checks as integrated payment options. Your invoices will go out with a button that customers can click to provide bank card or check information.

Check and uncheck the invoices by clicking into the leftmost checkmark column to apply and remove payment amounts, as needed. Do this until the entire amount received is attributed to the correct invoices in the correct amounts. You can also change the amounts applied to each invoice, if needed, by changing the amounts in the “Payment” column at the right end of the outstanding invoice list. You can apply one payment to multiple invoices in QuickBooks for a single customer. To do this, place a checkmark in the checkmark column to the left of the invoices against which you want to apply the cumulative payment amount received. Repeat this until the total payment has been distributed to the correct invoices.

There is a $25 chargeback fee and PCI compliance service costs $9.95 per month. However, customer service isn't 24/7 and the QuickBooks point-of-sale system it works with has limited hardware options. Dummies has always stood for taking on complex concepts and making them easy to understand. Dummies helps everyone be more knowledgeable and confident in applying what they know. It is possible to delete the entire transactions which went wrong. The important step in the import is to map your file headers to the QuickBooks field in Step 3 of the import.

Bluevine Small Business Loans Review - Nasdaq

Bluevine Small Business Loans Review.

Posted: Tue, 14 Mar 2023 18:34:00 GMT [source]

You will next need to use the “Bank Deposit" function to record these payments to the correct account in QuickBooks. Click “Record Deposits” window and add the correct deposits from undeposited funds. Receiving payments inside of QuickBooks online is pretty simple. The article linked below was created by their support team and lists all of the steps. If the customer has multiple outstanding invoices, QuickBooks Online will put a check mark in front of the oldest one. You can change this if you need to by clicking to uncheck the box and clicking in the box in front of the correct one.

Given how high QuickBooks payments fees can be, you might be wondering if it’s worthwhile to continue using QuickBooks to process credit card payments. Use the “Record Deposits” window to select all of the payments in the undeposited funds account. Next, you’ll need to ensure that the payment is applied to the right invoices.

In the "top xero courses online from" field, input the customer’s name; this will display a list of all open invoices. Let’s start our article about reverse a credit in QuickBooks. The program uses credit memos when a refund is given ... As we said before, QuickBooks is by far the most popular business accounting program in the United States.